Bookkeeping

Fixed Assets in Accounting Definition, List Top Examples

NỘI DUNG TRANG

Content

If the company doesn’t perform well, the company valuation could go down simply because it isn’t using its resources effectively. In our short example, we saw three ways three different assets were acquired. First, the company acquired equipment by a contribution from its owners. Second, the company used its own assets to purchases more assets when it bought additional equipment with its cash. Let’s look at each with an example of a business formation because a company can acquire its resources in a number of different ways. Get instant access to video lessons taught by experienced investment bankers.

Certain assets, called fixed assets, provide value to a company over multiple fiscal years. Commonly called property, plant and equipment , their primary function is to support a business’s operations. Fixed assets tend to be substantial — not only in terms of cost and, sometimes, physical size, but also in the ways their accounting treatment brings benefits to a company. Fixed assets are imperative in determining the profitability of a company. There are not immediately converted into money, and they assist companies in achieving their objectives.

Fixed Assets: Capitalized Accounting Treatment

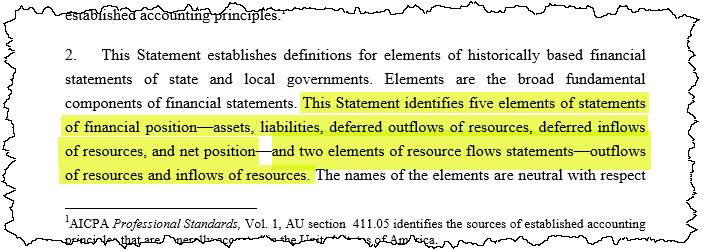

Intangible AssetsIntangible Assets are the identifiable assets which do not have a physical existence, i.e., you can’t touch them, like goodwill, patents, copyrights, & franchise etc. They are considered as long-term or long-living assets as the Company utilizes them for over a year. As mentioned, depreciation is the process of spreading an asset’s cost over a longer period of time. To determine your asset’s value, calculate depreciation expense. It can be difficult to determine the cost of an intangible asset because they are not physical property or items. In case of the impairment of an asset, its book value reduces compared to its net book value. The balance sheet must indicate this depreciation and reduce the price of the asset.

What are the 6 types of assets?

- Current.

- Non-current.

- Tangible.

- Intangible.

- Operating.

- Non-operating.

But fixed assets have various specific accounting requirements as well. Fixed asset management software, such as NetSuite Fixed Assets Management, eliminates the hassle of managing fixed assets using manual spreadsheets.

What Are Expenses? Definition, Types, and Examples

Get job-ready with Forage’s accounting virtual experience programs. Includes all types of computer equipment, such as servers, desktop computers, and laptops. Your business was launched in a little shop you rented, where you sold donuts and cupcakes. Your reputation grew and people flocked to your shop for your delicious baked goods.

- At acquisition, fixed assets are recorded on the balance sheet at the price paid plus any additional costs to make it ready for use, such as installation costs.

- Investment Advisory services are provided by First Republic Investment Management, Inc.

- Can include company cars, trucks, and more specialized moving equipment, such as fork lifts.

- If you don’t have work or internship experience in accounting, you can focus on coursework you had that involved core accounting skills, such as understanding assets, liabilities, and equity.

Fixed assets are properties that are bought for long-term use for the generation of Assets definition and types • Examples of fixed assets income. These are assets that are not likely converted into cash for a long time.

Market Value Method

Integrated https://madhurra.com/kamagra-oral-jelly-informasjonsartikler/ software and services for tax and accounting professionals. Includes the purchased cost of land, and may also include the cost of land improvements . Usually only includes the most expensive types of software; all others are charged to expense as incurred. INVESTMENT BANKING https://business-accounting.net/ RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Generally, It requires significant investment and cash outflows when they are purchased. Examples include plant and machinery, land and building, furniture, computer, copyright, and vehicles.

- Downey is thinking of starting a business near the coast of Gujarat.

- The other items, such as the flour, sugar, and eggs, are purchased and sold as part of your regular business sales; those items are not considered fixed assets.

- This means that its recorded value on the balance sheet is adjusted downward to reflect that it is overvalued compared to the market value.

- Inventory – trading these assets is a normal business of a company.

- A company’s operating assets are resources that are vital for daily function.

- Under U.S. GAAP reporting, fixed assets are typically capitalized and expensed across their useful life assumption on the income statement.

- Other businesses, like a home business that generates crocheted blankets, will require next to no fixed assets.

I am actually delighted to glance at this weblog posts which includes tons of useful data, thanks for providing these kinds of information. Investment Advisory services are provided by First Republic Investment Management, Inc. First Republic Trust Company takes a hands-on, personalized approach to a variety of trust services. First Republic Investment Management, an SEC Registered Investment Advisor, offers objective, individualized wealth management solutions. Equipment like machinery, vehicles, and furniture all has a useful life of more than one year. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

What are Assets?

However, if the laptop is being used for personal use, it would not be considered a fixed asset and would not be recorded on the company’s balance sheet. Current assets include cash and cash equivalents, accounts receivable , inventory, and prepaid expenses. What fixed assets are, and the role they play, differ between businesses and individuals. In general, they’re long-term, tangible assets owned by a company or person. Some long-term, tangible assets can help you generate income, whether through the manufacture of goods or through their appreciation over time, whereas others might depreciate over time.

- The current assets of a company include cash reserves, inventory, prepaid expenses, accounts receivable, etc.

- Some long-term, tangible assets can help you generate income, whether through the manufacture of goods or through their appreciation over time, whereas others might depreciate over time.

- The same is true for people who may want to incorporate real estate or other tangible items into their overall net worth.

- The most common methods are straight-line and double declining balance.

- First, he starts a firm with the name of 3M and registers it with the relevant authorities.

Fixed assets are less liquid, meaning you list them further down on your balance sheet. Types of current assets may include things like cash, accounts receivable, inventory, and prepaid expenses.