Bookkeeping

What Is the Debt-To-Equity Ratio and How Is It Calculated?

NỘI DUNG TRANG

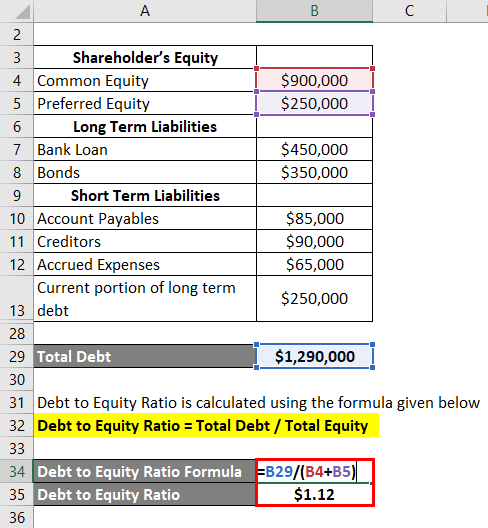

This is also true for an individual applying for a small business loan or a line of credit. The personal D/E ratio is often used when an individual or a small business is applying for a loan. Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income. Finally, 10 benefits and limitations of swot analysis you should know about if we assume that the company will not default over the next year, then debt due sooner shouldn’t be a concern. In contrast, a company’s ability to service long-term debt will depend on its long-term business prospects, which are less certain. If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1.

The Limitations of Debt-to-Equity Ratios

If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk. There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio. A D/E ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. Because equity is equal to assets minus liabilities, the company’s equity would be $800,000. Its D/E ratio would therefore be $1.2 million divided by $800,000, or 1.5. The debt-to-equity ratio is most useful when used to compare direct competitors.

Part 2: Your Current Nest Egg

The general consensus is that most companies should have a D/E ratio that does not exceed 2 because a ratio higher than this means they are getting more than two-thirds of their capital financing from debt. You can calculate the D/E ratio of any publicly traded company by using just two numbers, which are located on the business’s 10-K filing. However, it’s important to look at the larger picture to understand what this number means for the business. You can find the balance sheet on a company’s 10-K filing, which is required by the US Securities and Exchange Commission (SEC) for all publicly traded companies.

- While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule.

- The debt-to-equity ratio is most useful when used to compare direct competitors.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- If the company is aggressively expanding its operations and taking on more debt to finance its growth, the D/E ratio will be high.

- For a mature company, a high D/E ratio can be a sign of trouble that the firm will not be able to service its debts and can eventually lead to a credit event such as default.

Can a Debt Ratio Be Negative?

A company that does not make use of the leveraging potential of debt financing may be doing a disservice to the ownership and its shareholders by limiting the ability of the company to maximize profits. The optimal debt-to-equity ratio will tend to vary widely by industry, but the general consensus is that it should not be above a level of 2.0. While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule.

Debt-to-equity ratio is just one piece of the puzzle when it comes to evaluating stocks. Whether the ratio is high or low is not the bottom line of whether one should invest in a company. A deeper dive into a company’s financial structure can paint a fuller picture.

Thus, many companies may prefer to use debt over equity for capital financing. In some cases, the debt-to-equity calculation may be limited to include only short-term and long-term debt. Together, the total debt and total equity of a company combine to equal its total capital, which is also accounted for as total assets. This looks at the total liabilities of a company in comparison to its total assets. On the surface, this may sound like the debt ratio formula is the same as the debt-to-equity ratio formula. However, the total debt ratio formula includes short-term assets and liabilities as part of the equation, which the debt-to-equity ratio discounts.

Long-term liabilities are debts whose maturity extends longer than a year. Not all debt is considered equally risky, however, and investors may want to consider a company’s long-term versus short-term liabilities. Generally speaking, short-term liabilities (e.g. accounts payable, wages, etc.) that would be paid within a year are considered less risky. An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations. However, industries may have an increase in the D/E ratio due to the nature of their business.

A debt ratio of 30% may be too high for an industry with volatile cash flows, in which most businesses take on little debt. A company with a high debt ratio relative to its peers would probably find it expensive to borrow and could find itself in a crunch if circumstances change. Conversely, a debt level of 40% may be easily manageable for a company in a sector such as utilities, where cash flows are stable and higher debt ratios are the norm. Debt and equity compose a company’s capital structure or how it finances its operations. The debt to equity ratio can be used as a measure of the risk that a business cannot repay its financial obligations. Total debt represents the aggregate of a company’s short-term debt, long-term debt, and other fixed payment obligations, such as capital leases, incurred during normal business operations.

The above content provided and paid for by Public and is for general informational purposes only. It is not intended to constitute investment advice or any other kind of professional advice and should not be relied upon as such. Before taking action based on any such information, we encourage you to consult with the appropriate professionals. Market and economic views are subject to change without notice and may be untimely when presented here. Do not infer or assume that any securities, sectors or markets described in this article were or will be profitable. Historical or hypothetical performance results are presented for illustrative purposes only.

Understanding the debt to equity ratio is essential for anyone dealing with finances, whether you’re an investor, a financial analyst, or a business owner. It shines a light on a company’s financial structure, revealing the balance between debt and equity. It’s not just about numbers; it’s about understanding the story behind those numbers.

For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies. It shows the proportion to which a company is able to finance its operations via debt rather than its own resources. It is also a long-term risk assessment of the capital structure of a company and provides insight over time into its growth strategy. When evaluating a company’s debt-to-equity (D/E) ratio, it’s crucial to take into account the industry in which the company operates.